Xencor and Novartis reached a huge partnership deal Tuesday, sending the stock of Xencor skyrocketing. We wanted to share our analysis on Biotechr on the deal and what it might mean for both Xencor ($XNCR), Novartis ($NVS), and their competitors. I will focus on the CD20 antigen target as a paradigm for contrasting the differences between current drugs and how Xencor could differentiate themselves.

CD20 is an antigen expressed on B cells that has gained much success in being targeted by antibody-based drugs, such as rituximab, to treat B cell malignancies. However, as rituximab took off, some limitations in its efficacy were seen. Importantly, it was determined that antibody-dependent cell cytotoxicity (ADCC) drove much of the mechanism of action of rituximab. ADCC engages the Fc domain on rituximab to an Fc receptor on an effector cell such as natural killer cells or macrophages. While potent, ADCC is somewhat limited in absolute toxicity. In order to boost efficacy, scientists found that engaging T cells through the CD3 receptor could cause potent T cell activation and cytotoxicity against a targeted cell antigen.

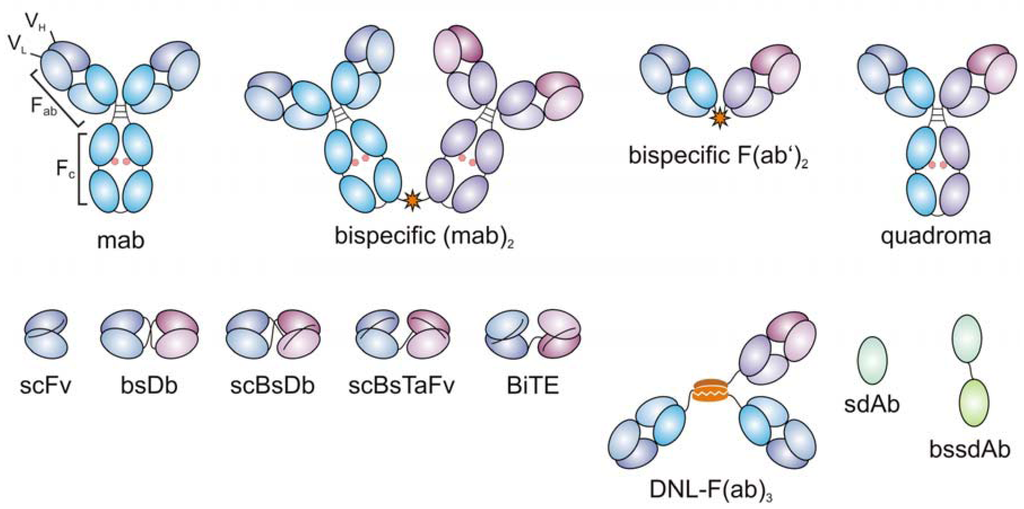

This same strategy of engaging T cells in a bispecific format has, of course, been utilized by many different companies to date. Prominently, blinatumomab is an approved bispecific antibody that connects CD19 and CD3 binding components. Owned by Amgen, the format links two different single chain variable fragments in tandem, such that that they will correctly pair heavy and light chains of the respective scFv's. The small protein forms a short synapse that afforded potent activation of T cells, compared to previous whole antibody versions. However, without the Fc domain, the half-life of the protein is very short, requiring constant infusion in order to obtain the therapeutic window necessary for efficacy and cross-linking of tumor and T cells.

|

| Xencor Bispecific Ab (image from their site) |

This leads us back to the Xencor program. On a simple level, Xencor uses an Fc domain in its construct, thereby affording greater half-life and thus reduced dosing. Their design resembles the "quadroma" format listed below, with differences in antigen binding domains. It is well known that Fc receptor binding must be eliminated, however, in order to avoid systemic toxicity from T cell activation and cytokine release syndrome, so it can be assumed this is built into the Xencor approach. Xencor also has mutations in its platform technologies to increase FcRn binding in order to afford even greater half-life. It's unknown, however, how potent Xencor's molecules are in activating T cells head to head versus a smaller BiTE or DART format (shown in the figure below), which were previously published to be more effective in cross-linking T cells and lack toxicity. Will the benefit of longer half-life outweigh potency reduction? The jury is out, and it's possible Xencor has something up its sleeve to solve this previously, including possibly using an scFv against a more effective CD3 epitope.

|

| From http://www.mdpi.com/2073-4468/1/2/172/htm |

The current portfolio against B cell tumors is wide, so forecasting where this fits into the market is uncertain. The traditional antibody drugs are only getting better, whether it is new targets or enhanced Fc domains or antibody-drug conjugates. It will be costly to onboard yet another factory to make a unique biologic, and it has been speculated that most of the cash will go toward production costs. Certainly, this strategy represents a more robust off-the-shelf product compared to the CAR-T platform Novartis has heavily invested in. Comparing the two, CAR-T cells can detect antigens at lower thresholds versus bispecific antibodies, have the benefit of proliferating in the patient, and the potential to be a long-lasting single dose therapy. Head to head, a CAR-T cell is more potent than a cross-linked antibody based molecule. However, scaling and ease of use is much more in the favor of the bispecific antibody format here, and safety will be advantageous as well. Rather than using CRISPR to enhance cell therapy as has garnered recent headlines, simple combination with checkpoint inhibitors should be sufficient for increased efficacy. I like the terminology "backup plan" used by Jacob Plieth to describe the deal, although I would suspect large pharmaceutical players view it as owning all technology platforms and then letting the winners develop from there, rather than deciding technology first. In time, one could imagine rituximab generic being used as first line therapy, followed by a bispecific or ADC targeting CD20, and followed lastly by a third line CAR-T therapy if those patients fail. In this scenario, a pay for performance scheme would have to reign, as it is hard to imagine payers paying hundreds of thousands of dollars for three separate lines of therapy, but rather a single sum for the entire management of the disease.

For investors trading in other antibody companies with bispecific platforms, the Xencor deal is enticing to see if these companies too might be targets for new partnerships and/or acquisitions. Most of the intellectual property in bispecific antibodies revolves around mutated sequences and production/isolation techniques, meaning the general strategy and shape of the proteins is largely the same and perhaps equivalent among the formats. A single success for the class could raise the value of others, although the challenges of commercializing me-too candidates in immuno-oncology is increasingly scrutinized, as covered by Bruce Booth in a recent post in Forbes. I think what might be more important going forward are companies distinguishing themselves by what antigens they are targeting, since the CD20 and CD123 antigens in the Xencor-Novartis deal are already heavily covered by all biotech companies using different modalities, meaning the fight is just over marginal differences in potency. In light of that, it makes sense why we still see antibody discovery companies make huge partnership deals today even after the technology has long matured, as the race for new and better candidates continues.